Get the free 2019 form 1040 es payment voucher

Show details

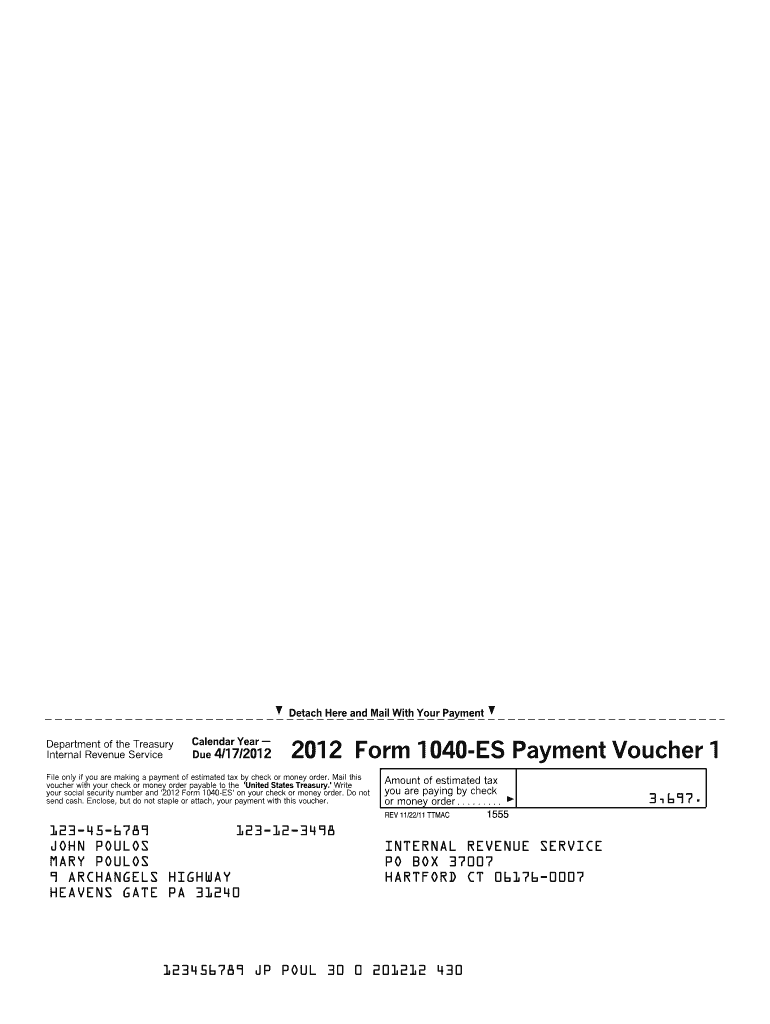

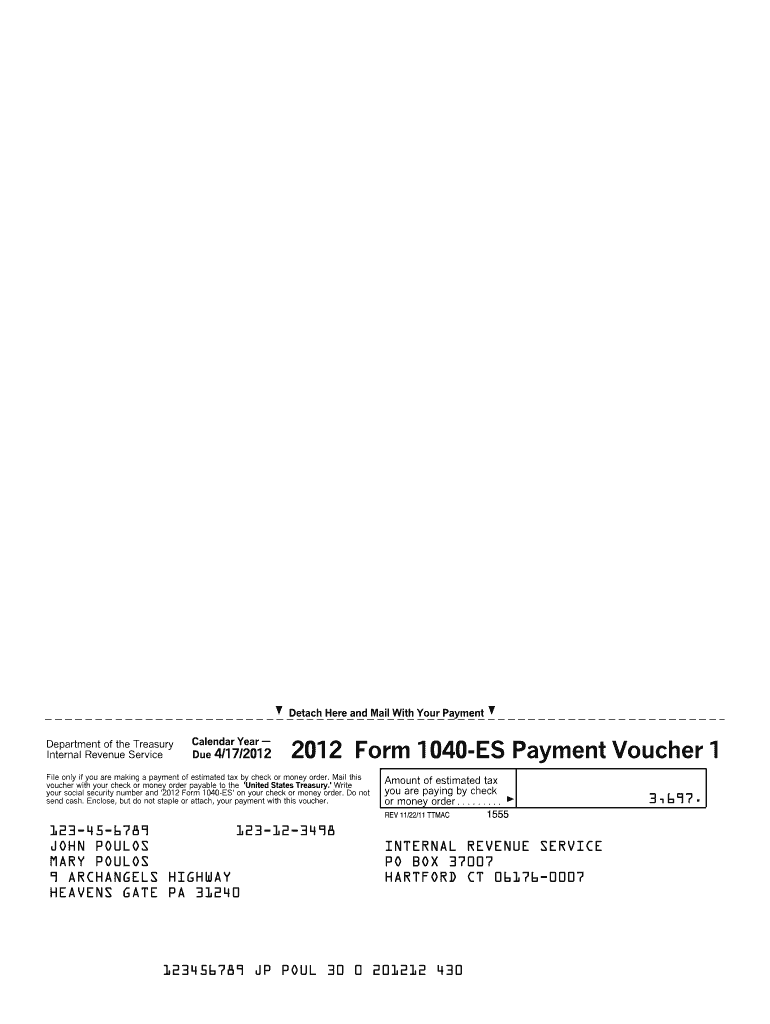

I Detach Here and Mail With Your Payment I Department of the Treasury Internal Revenue Service Calendar Year Due 4/17/2012 2012 Form 1040-ES Payment Voucher 1 Amount of estimated tax you are paying

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2019 form 1040 es form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2019 form 1040 es form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2019 form 1040 es payment voucher online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irs form 1040 es 2019 fillable. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

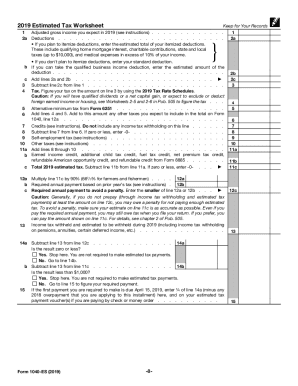

How to fill out 2019 form 1040 es

How to fill out 2022 form 1040 es:

01

Start by entering your name, address, and social security number in the designated sections of the form.

02

Next, calculate your total expected income for the year and report it in the appropriate line.

03

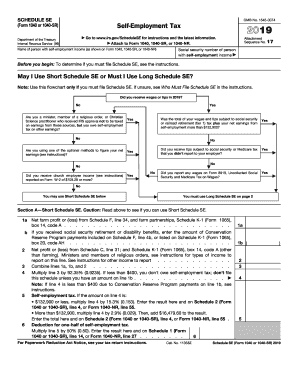

Deduct any applicable adjustments to income, such as student loan interest or self-employment tax.

04

Calculate the total taxable income by subtracting deductions and exemptions from the adjusted gross income.

05

Use the tax tables provided by the IRS to determine the amount of tax owed based on your taxable income.

06

If you expect to owe more than $1,000 in taxes for the year, you need to make estimated tax payments. Fill out the appropriate sections to report your estimated tax payments.

07

Finally, make sure to sign and date the form before submitting it to the IRS.

Who needs 2022 form 1040 es:

01

Individuals who have income that is not subject to withholding, such as self-employment income, rental income, or investment income, may need to file form 1040 es to report and pay estimated taxes.

02

If you expect to owe more than $1,000 in taxes for the year, you will also need to file form 1040 es to make estimated tax payments.

03

Additionally, individuals who had a tax liability in the previous year and anticipate owing taxes for the current year may also need to file form 1040 es to avoid penalties for underpayment of taxes.

Video instructions and help with filling out and completing 2019 form 1040 es payment voucher

Instructions and Help about form 1040es

Laws calm legal forms guide form 1040 — AES is a United States Internal Revenue Service tax form used as an estimated tax payment voucher the form includes four separate vouchers Aldrin quarterly filings throughout the year the form 1040

Fill fillable 1040 es : Try Risk Free

People Also Ask about 2019 form 1040 es payment voucher

How do I get an IRS payment voucher?

Do I have to pay 2022 Form 1040-ES payment voucher?

How do I make an estimated tax payment for 2022?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 1040 es payment?

Form 1040-ES is a payment voucher the Internal Revenue Service (IRS) uses to collect self-employment taxes from individuals. This form is used to estimate tax payments throughout the year, and the payments made using this form are applied to the individual's tax return for the tax year.

What is the purpose of form 1040 es payment?

Form 1040-ES is an IRS form used to calculate estimated tax payments for individuals. It is used to estimate and pay the amount of taxes owed on income that is not subject to withholding. The form helps taxpayers plan for their tax liability throughout the year and make estimated tax payments as needed.

When is the deadline to file form 1040 es payment in 2023?

The deadline to file Form 1040-ES Payment for the 2023 tax year has not yet been announced. Generally, the deadline is usually sometime in April of the following year.

What is the penalty for the late filing of form 1040 es payment?

The penalty for late filing of Form 1040 ES payment is 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%.

Who is required to file form 1040 es payment?

Individuals who have income that is not subject to withholding or who have income that is not fully covered by withholding are generally required to make estimated tax payments using Form 1040-ES. This includes self-employed individuals, freelancers, independent contractors, and individuals with significant investment income. Additionally, individuals who expect to owe at least $1,000 in tax after subtracting their withholding and refundable credits are also required to file Form 1040-ES.

What information must be reported on form 1040 es payment?

When making a payment on Form 1040-ES (Estimated Tax for Individuals), the following information must be reported:

1. Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): This is used to identify the taxpayer.

2. Tax Year: Indicate the tax year for which the estimated payment is being made.

3. Estimated Tax Payment Amount: Enter the total amount of estimated tax payment you are submitting for the specific tax year.

4. Date: Provide the date on which you are making the payment.

5. Your Name and Address: Include your name and current address.

It is important to accurately and completely fill out this information to ensure that the payment is properly credited to your tax account.

How to fill out form 1040 es payment?

To fill out Form 1040-ES payment, follow these steps:

1. Obtain a copy of Form 1040-ES. You can download it from the official Internal Revenue Service (IRS) website or request a copy by mail.

2. Section 1 of the form requires you to provide your personal information, such as your name, Social Security number, and address. Fill in these details accurately.

3. In Section 2, you need to estimate your expected income for the year and calculate your adjusted gross income (AGI). Use the information you have, such as pay stubs, previous year's income, or any other income documentation, to make an estimate. If you anticipate significant changes in your income during the year, you might need to re-estimate and adjust your payments.

4. After estimating your AGI, you can subtract any deductions, exemptions, or credits to calculate your taxable income. This is done in Section 3.

5. In Section 4, you will need to determine your estimated tax liability for the year. This requires you to refer to the tax tables provided with the form or use the IRS tax computation worksheet. Adjustments might be required if you have any specific situations, such as self-employment income or capital gains.

6. Once you have calculated your estimated tax liability, you can subtract any credits or payments you have already made throughout the year, such as withholding taxes from your paycheck or estimated tax payments made for each quarter.

7. Section 5 is used to determine the amount you need to pay for each installment. This section helps you calculate the required payment for the current quarter and helps you plan for future payments.

8. If you choose to pay by check, make the check payable to "United States Treasury" and write your Social Security number, "Form 1040-ES," and the tax period you are paying (e.g., "2021 Form 1040-ES 2nd Quarter") in the memo line. If you prefer to pay electronically, you can use the Electronic Federal Tax Payment System (EFTPS).

9. Along with your payment, include Form 1040-ES payment voucher, which is included in the Form 1040-ES package. Make sure to fill out the payment voucher accurately, including your name, address, Social Security number, and applicable tax year.

10. Keep a copy of the filled-out Form 1040-ES, payment voucher, and proof of payment for your records. These documents might be required for future references or in case of an audit.

It is important to note that if you are unsure about any aspect of filing Form 1040-ES or calculating your estimated tax payments, it is recommended to consult a qualified tax professional or use tax software to ensure accuracy and compliance with IRS guidelines.

How can I manage my 2019 form 1040 es payment voucher directly from Gmail?

irs form 1040 es 2019 fillable and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make changes in printable 2019 form 1040 es payment voucher?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your 1040 es fillable to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out printable 2019 form 1040 es on an Android device?

On an Android device, use the pdfFiller mobile app to finish your printable 1040 es payment voucher form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your 2019 form 1040 es online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Printable 2019 Form 1040 Es Payment Voucher is not the form you're looking for?Search for another form here.

Keywords relevant to pay 1040 es voucher online form

Related to form 1040es fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.